- Payroll analytics refers to the process of collecting, analyzing, and interpreting payroll data to support decision-making in HR and finance operations.

- Implementing it has many benefits, such as better control over payroll costs and budgeting

Payroll is one of the largest and most sensitive operational expenses in any organization. It directly impacts employee satisfaction, financial planning, and regulatory compliance.

Despite its importance, traditional payroll reporting often focuses only on calculations, ensuring salaries are processed accurately, rather than generating insights.

As organizations grow, payroll data becomes increasingly complex. Multiple salary structures, departments, shifts, benefits, and statutory deductions make it difficult to analyze payroll manually using spreadsheets. This is where payroll analytics becomes essential.

Payroll analytics helps HR and finance teams transform payroll data into actionable business insights.

What Is Payroll Analytics?

Payroll analytics refers to the process of collecting, analyzing, and interpreting payroll data to support decision-making in HR and finance operations.

Unlike traditional payroll reporting, which primarily summarizes payroll calculations (e.g., total salaries paid this month), payroll analytics goes further by identifying trends, patterns, and anomalies within payroll data.

For example:

- Payroll reporting answers: How much did we pay this month?

- Payroll analytics answers: Why did payroll costs increase? Which department contributed most to overtime expenses? Are salary adjustments aligned with budget forecasts?

Payroll analytics transforms raw payroll data into insights that help organizations control costs, improve accuracy, and plan workforce strategies.

Payroll analysts or HR professionals use payroll analytics to evaluate compensation trends, monitor payroll errors, identify inefficiencies, and support management reporting. In modern organizations, payroll analytics bridges the gap between HR operations and financial strategy.

Read more: Understanding On-Cycle vs Off-Cycle Payroll: Key Differences and When to Use Each

Payroll Data Analyzed in Payroll Analytics

Payroll analytics covers a wide range of payroll-related data. Some of the most commonly analyzed elements include:

Total payroll cost

Understanding total payroll expenditure helps organizations manage budgets and monitor cost growth over time.

Salary and wage distribution

Analyzing salary distribution by role, level, or department ensures fairness and internal equity.

Overtime and shift premiums

Excessive overtime can significantly inflate payroll costs. Payroll analytics helps identify inefficiencies and operational bottlenecks.

Allowances, benefits, and deductions

Tracking bonuses, allowances, tax deductions, and statutory contributions ensures compliance and transparency.

Payroll cost by department, role, or location

Breaking down payroll costs by business unit enables better financial planning and accountability.

Payroll trends over time (monthly, quarterly, yearly)

Trend analysis reveals cost growth patterns and seasonal fluctuations.

Payroll accuracy, adjustments, and error rates

Monitoring corrections and payroll revisions helps improve process accuracy and reduce recurring mistakes.

Read more: Payroll Data Encryption: Why Security Matters

Benefits of Payroll Analytics

Implementing payroll analytics provides significant business advantages:

Better control over payroll costs and budgeting

Organizations gain clearer visibility into payroll expenses and can proactively manage cost overruns.

Improved payroll accuracy and reduced errors

By analyzing adjustment patterns and discrepancies, companies can identify root causes of payroll issues.

Support for fair and consistent compensation decisions

Payroll analytics provides objective data to guide salary reviews and bonus planning.

Increased transparency for HR, finance, and management

Shared dashboards and reports foster collaboration between departments.

Data-driven workforce planning and headcount decisions

Payroll data supports decisions regarding hiring, restructuring, or cost optimization.

Stronger compliance and audit readiness

Accurate and well-documented payroll analytics strengthens financial reporting and regulatory compliance.

How to Use Payroll Analytics in HR Operations

Payroll analytics is not just a strategic tool, it also supports day-to-day operations.

Monitoring payroll trends and cost growth

HR and finance can track whether payroll costs align with budget forecasts.

Identifying overtime inefficiencies

Data analysis can reveal departments with excessive overtime, prompting operational adjustments.

Supporting salary review and compensation planning

Payroll analytics helps ensure raises and bonuses are aligned with company performance and financial targets.

Aligning payroll data with attendance and performance data

Integrating payroll with attendance and performance insights provides a more holistic view of workforce productivity.

Providing insights for management reporting and strategic planning

Executives rely on payroll insights to evaluate workforce investment and cost structures.

Best Practices for Using Payroll Analytics Effectively

1. Centralize Payroll and HR Data in One System

Payroll analytics is most effective when payroll, attendance, and employee data are integrated. Fragmented data across spreadsheets or disconnected systems limits accuracy and scalability.

2. Define Clear Payroll KPIs and Metrics

Establish key payroll metrics such as payroll cost per employee, overtime ratio, salary growth rate, and payroll error rate. Clear KPIs ensure consistent analysis.

3. Analyze Payroll Data Regularly

Payroll analytics should not be a one-time exercise. Regular monthly or quarterly reviews provide continuous insight into cost and compliance trends.

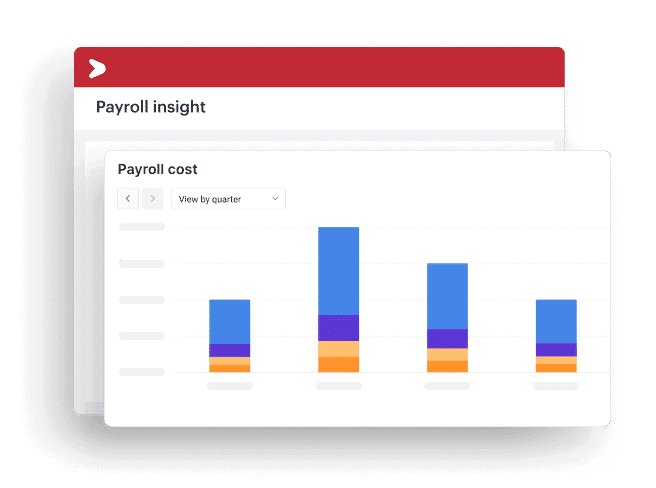

4. Use Visualization and Dashboards for Easier Interpretation

Dashboards and visual reports make payroll data easier to interpret and share with management. Clear visualization reduces reliance on raw spreadsheets.

5. Use Payroll Software or HRIS to Enable Payroll Analytics

Manual tools are limited in scalability and prone to errors. Using integrated Payroll software or HRIS systems ensures reliable data collection and real-time reporting.

Read more: Understanding Global Payroll Management

Build Smarter Payroll Decisions with Payroll Analytics from Mekari Talenta

Payroll analytics becomes increasingly difficult to manage with manual tools or disconnected systems. As organizations grow, spreadsheets and ad-hoc reports cannot keep up with complexity.

Payroll analytics software or HRIS platforms simplify data collection and analysis by centralizing payroll and HR data within a controlled environment.

Mekari Talenta is a payroll software and HRIS platform within Mekari’s integrated software ecosystem. It provides payroll analytics, reporting, and HRIS solutions to help organizations gain better visibility into payroll data and workforce costs.

As part of its HR Analytics module, Mekari Talenta enables:

- Integrated payroll and attendance data

- Real-time payroll insights and automated reports

- Reduced manual processing and data inconsistencies

- Better visibility into payroll costs and trends

You can see how payroll analytics dashboards are presented in Mekari Talenta here:

By combining payroll processing with HR analytics capabilities, Talenta helps HR and finance teams move beyond basic reporting toward smarter, data-driven payroll decisions.

If your organization is transitioning from manual payroll reporting to structured analytics, exploring integrated HRIS Solutions can be a strategic next step.

Payroll analytics empowers organizations to manage workforce costs more effectively, improve accuracy, and support strategic growth.

To learn how Mekari Talenta can help you implement secure, data-driven payroll analytics, schedule a Demo and explore how integrated payroll insights can transform your HR and finance operations.