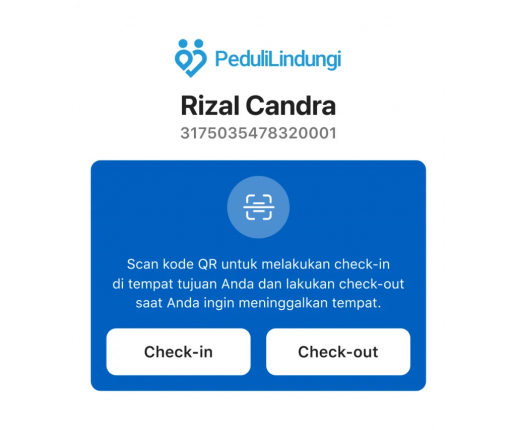

- Attendance Management

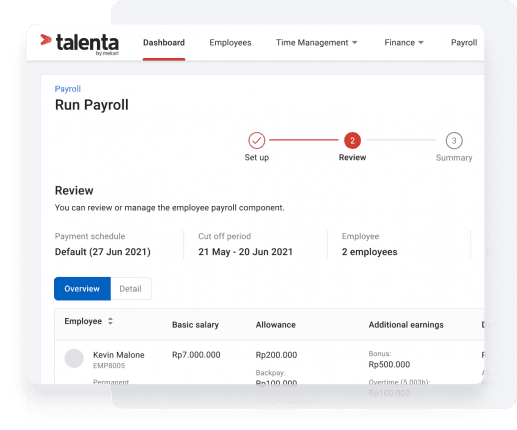

- Payroll Management

- AI & Analytics

- Productivity & Engagement

- Talent Management

- Company Data & System Integration

Attendance Management

Payroll Management

AI & Analytics

Productivity & Engagement

Talent Management