Ditch the manual, time-consuming work, and start automating all your tax and payroll scheme calculations

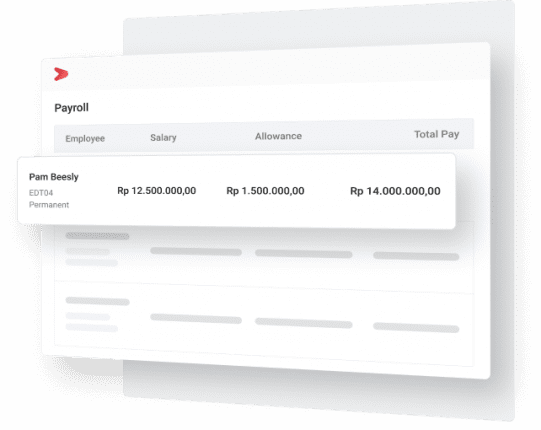

Customize and Generate Your Payroll Swiftly

- Spend less time and resources

- Prevent miscalculation with automated process

- Ensure compliance with the regulations

Automated Payroll Calculation

Calculate all the components faster, including employee taxes (PPh 21/PPh 26), employee bonus, loan, and many others in a single, automated platform

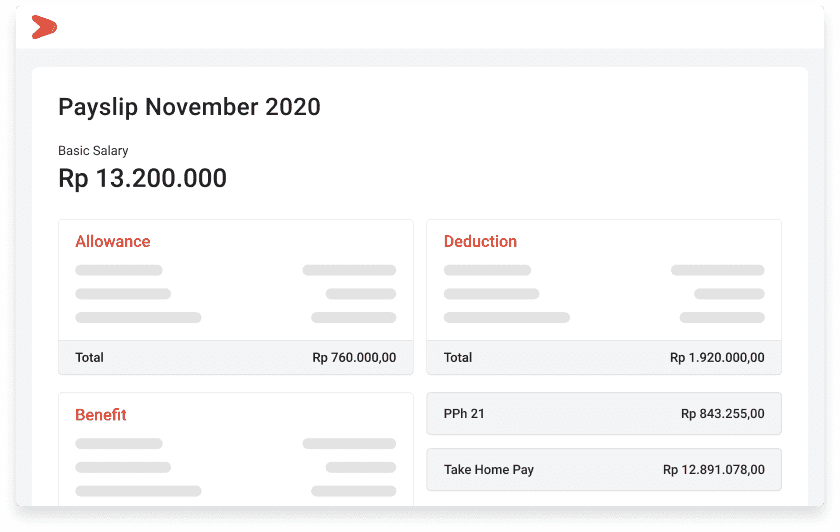

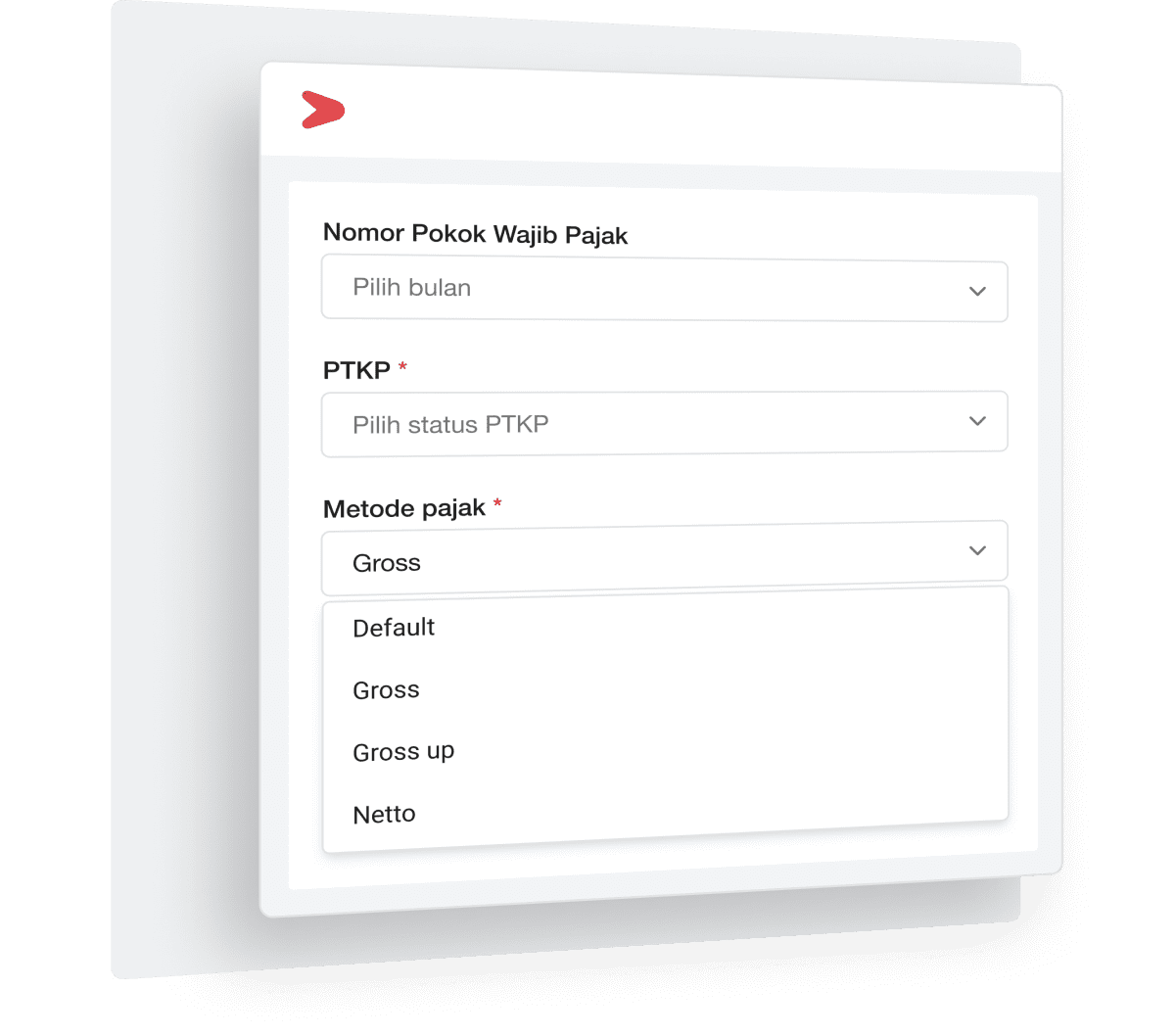

Income Tax Calculation

Automatically generate law-compliant payroll and tax reports with complete payroll components calculations, hassle-free

PPh 21 (PKWT/PKWTT)

Calculate income tax for domestic taxpayers (PPh 21) in various methods with precision

PPh 26 (PKWT/PKWTT)

Figure out the income tax for foreign taxpayers (PPh 26) easier with automated software

Non-Taxable Income

Adjust and calculate the non-taxable income rate according to the applicable regulations faster and easier

Bonus & Incentive

Sum up the employee's take-home bonus after tax deductions automatically

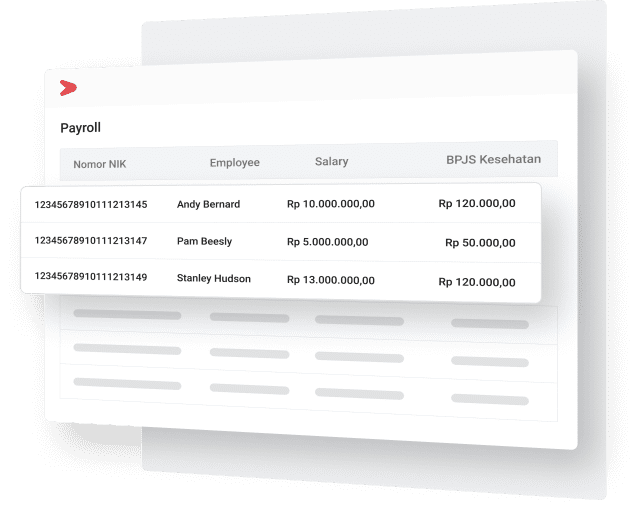

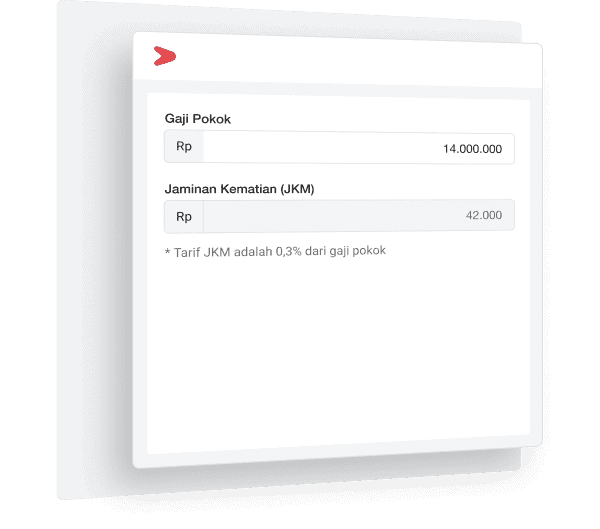

BPJS Ketenagakerjaan Calculation

Assess every required variable of BPJS Ketenagakerjaan in detail and automatically summarize the calculation for your report

Old Age Security

Calculate an employee's Old Age Security according to the applicable regulations, salary, and tenure

Pension Security

Create the Pension Security calculation according to the applicable regulations, salary, and tenure

Work-Related Accident Security

Set up a compliant Work-Related Accident Security that considers the employee's salary, status, and tenure

Death Security

Determine the amount of Death Security considering the applicable regulation and the employee's salary bracket

Irregular Income Calculation

Preprogram a disbursement template for non-recurring payment to be used whenever necessary

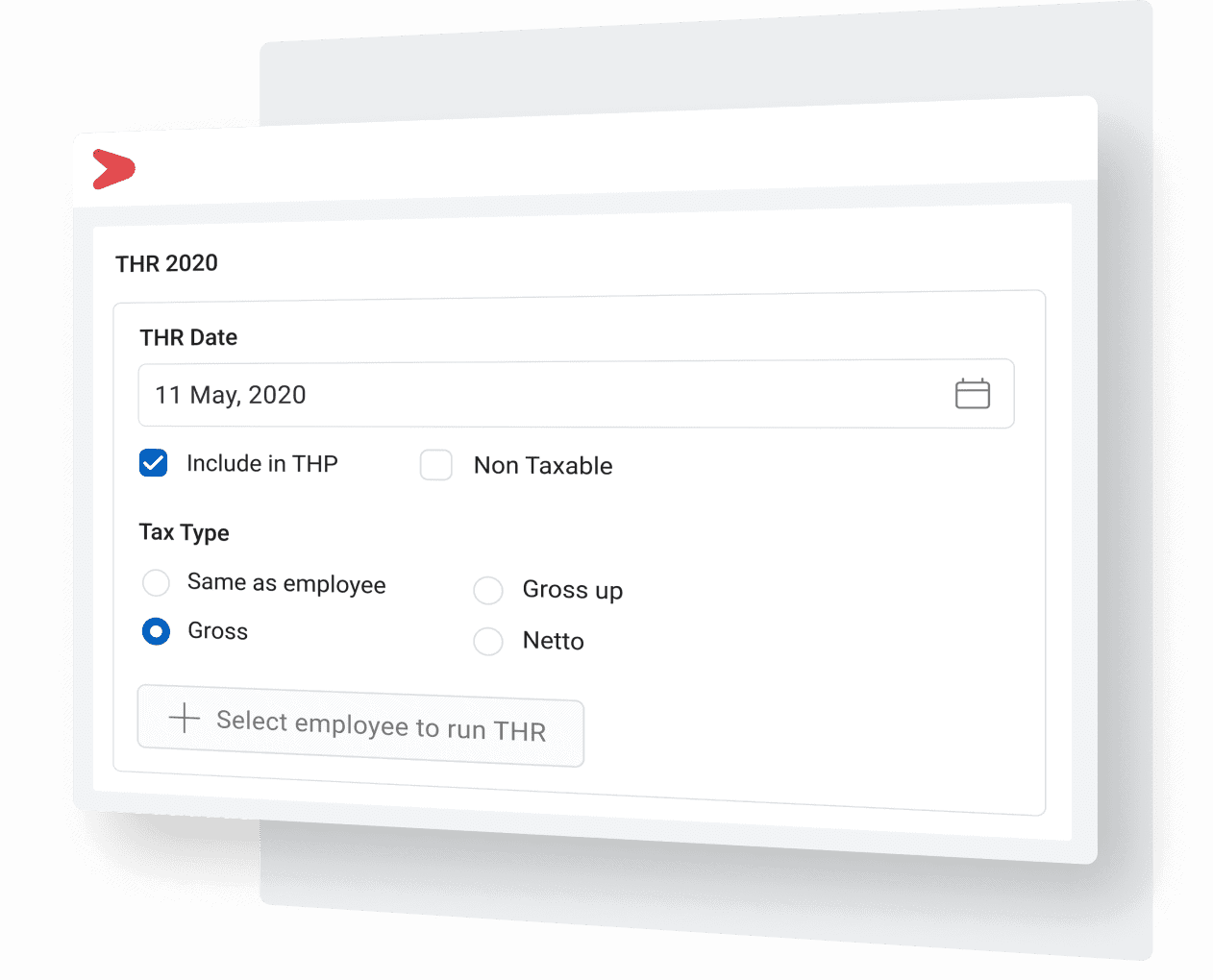

Religious Holiday Allowance

For the most-waited bonus of the year, automatically calculate everything here for easier reporting and disbursement later

Severance Package

Prepare the Severance Package according to one's salary and employment period to avoid unnecessary hassle later

Former Employee Benefit

Calculate and distribute Former Employee Benefit more easily by considering all important details, such as salary and tenure

Prorate

For Prorate payment, easily calculate it here based on one's employment period and salary

Employee Loan

Ensure wise and thorough Employee Loan calculation by taking into account the installment period and loan interest

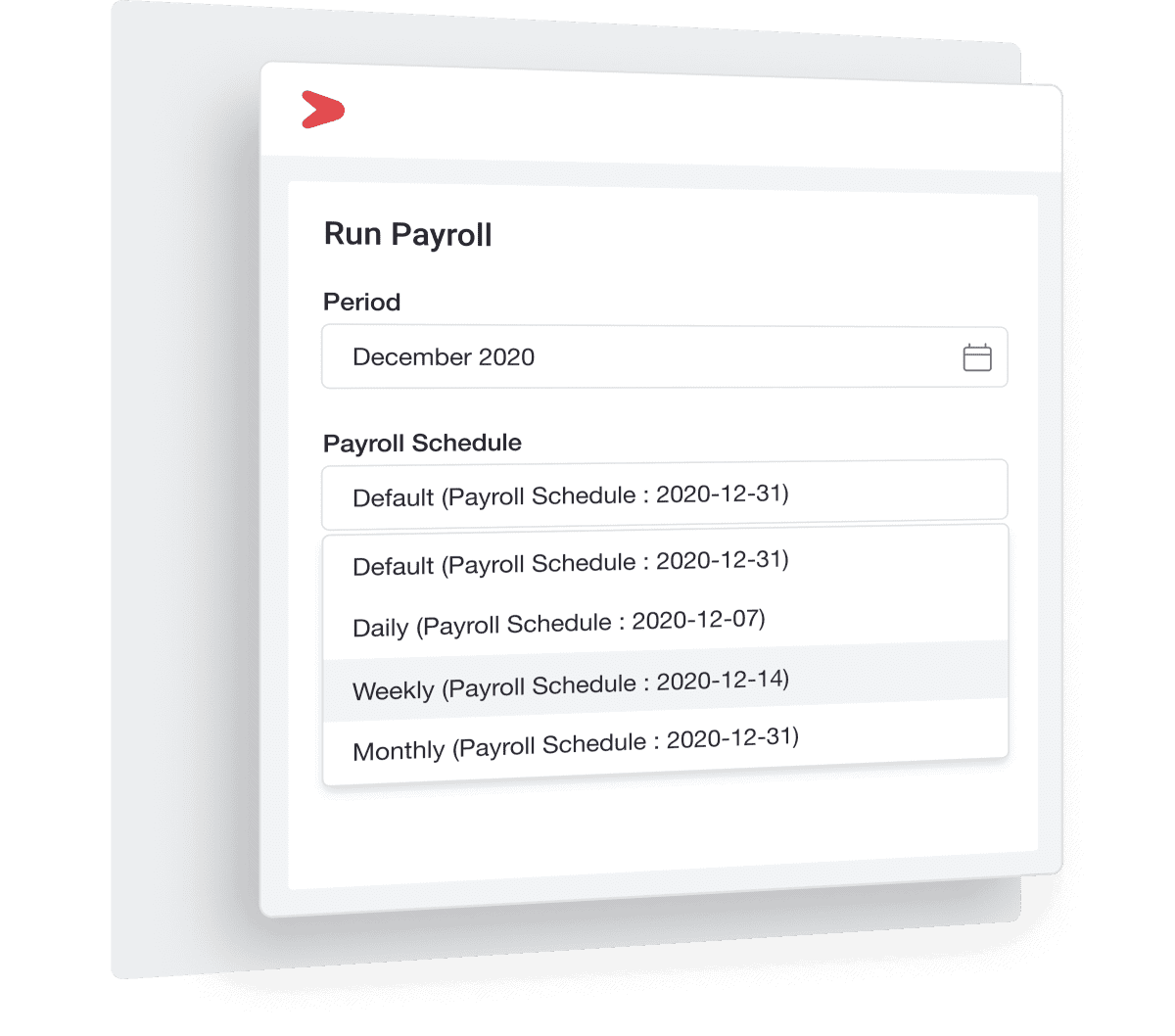

Multi-Cycle Payroll

No more depending on banks' cut-off date, now you can make your own to fit your business needs

Customized Access

Apply the highest security to your data with customized access for authorized employee only

Import/Export

Easily upload and download your payment data for reporting purposes

How Talenta payroll features can benefit your business

Automate your payroll components and tax calculation without any risk of human error with Talenta payroll calculation features

What is an employee payroll calculation application?

An employee payroll calculation application is a cloud based payroll system that helps companies calculate employee salaries and all related components automatically and in compliance with business and government regulations. By using a payroll application, companies can manage salary calculations more easily, efficiently, accurately, and securely without relying on manual processes.

This type of system typically includes automated calculations for allowances, deductions, taxes, and statutory contributions, along with integration to attendance, overtime, and leave data. It enables HR teams to streamline payroll operations, reduce errors, and ensure timely and compliant salary disbursement.

You can read the full set of questions and answers about using Mekari Talenta’s payroll here.

How does the Mekari Talenta payroll application work?

The Mekari Talenta payroll application operates automatically by pulling data directly from the attendance system, overtime records, leave management, and employee performance. All payroll components such as allowances, deductions, and income tax (PPh 21) are calculated automatically without manual input. Talenta also supports multi entity and multi location configurations, making it suitable for large companies with multiple business units.

Is the Mekari Talenta payroll system online and secure for enterprise use?

Yes. Mekari Talenta is a cloud based payroll software that is secure, fast, and accessible from anywhere through both web and mobile. It provides enterprise grade security with ISO 27001 certification, data encryption, and role based access control to protect sensitive payroll information.

Can Mekari Talenta calculate PPh 21 taxes and other components such as BPJS?

Yes. Mekari Talenta can calculate all payroll components automatically, including income tax PPh 21 and PPh 26, along with updates to PTKP according to the latest TER calculation rules. The system also handles BPJS Ketenagakerjaan and BPJS Kesehatan contributions in real time and integrates them directly into the payroll process. Talenta continuously updates its system to stay aligned with government regulations, ensuring that all calculations remain accurate and compliant without manual adjustments.

How does Mekari Talenta ensure ROI and efficiency for large enterprises?

Large enterprises can save up to 80% of the time spent on payroll processing while reducing the risk of calculation errors. In addition to operational efficiency, Mekari Talenta provides measurable payroll analytics, including labor cost reports by department and estimated overtime cost, helping HR teams make data driven decisions.

What happens if there are changes in government regulations related to BPJS, PPh, or labor policies?

Mekari Talenta automatically updates the system according to the latest government regulations, including changes to PPh 21 rates, PTKP, and BPJS contributions. This ensures companies do not need to manually adjust their payroll settings and can remain confident that all calculations follow the most current legal requirements.

Is the Mekari Talenta payroll application suitable for large companies with many entities or branches in different regions?

Yes. Mekari Talenta is designed to support enterprises with complex organizational structures. It offers multi entity management that allows each entity or branch to have its own payroll policies, including payment schedules, allowance components, and tax rules, while still being managed centrally within a single platform. This level of flexibility ensures consistent payroll processes across all locations without compromising accuracy or operational efficiency.

How can I subscribe to the Mekari Talenta payroll application?

You can visit https://www.talenta.co/en/contact-us/ to consult with our team and begin your subscription to Mekari Talenta, the leading HRIS solution.

One-stop HR solution for your business

Take your HR operations to the next level with the help of integrated solutions by Mekari Talenta