Manage payroll and PPh 21/26 eBupot faster in one platform

From payroll processing to generating PPh 21/26 withholding tax slips — everything runs in one platform. No file exports, no manual uploads.

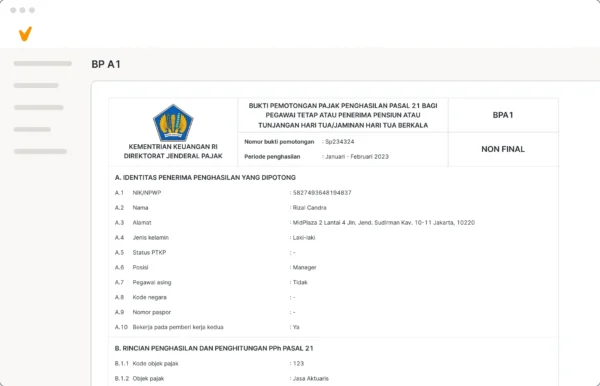

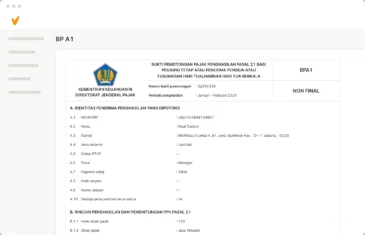

Automatically process multiple eBupot forms: 1721-VI, 1721-VII, 1721-VIII, and 1721-A1.

Securely integrated through Mekari Klikpajak, an official tax platform

ISO IEC 27001:2013

Directorate General of Taxation

Ministry of Communication and Digital of the Republic of Indonesia

A single integrated flow from payroll to tax reporting

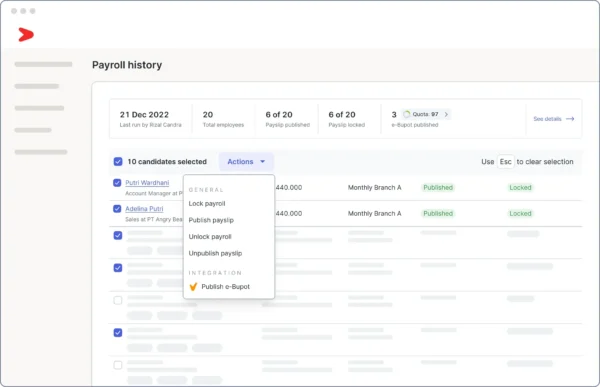

HR and finance teams can complete payroll and PPh 21/26 reporting in one system. Once payroll is finalized, official eBupot can be generated and sent to DJP Coretax through Mekari Talenta.

No manual export

Payroll directly generates official eBupot.

High security & accuracy

Data is encrypted and automatically validated.

Enterprise efficiency

Thousands of employees, one-click processing.

Simple steps to create and submit eBupot

All processes are handled in one platformn, without file exports and manual uploads.

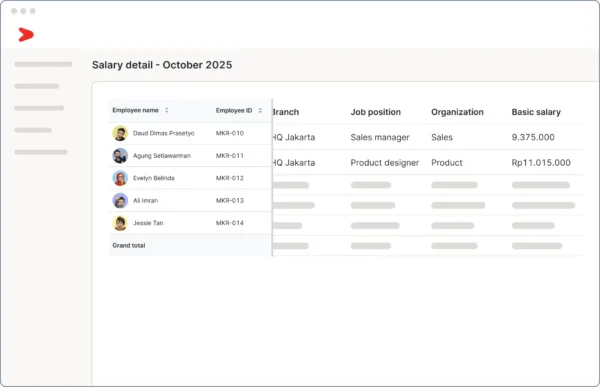

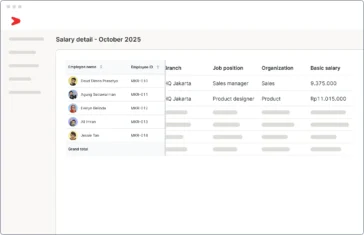

Run payroll in Mekari Talenta to accurately calculate salaries, deductions, and PPh 21/26 taxes.

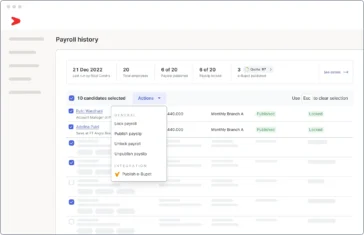

The system automatically prepares all the required data to generate eBupot for all employees or selected groups.

Monitor eBupot status without logging into another portal. All eBupot are validated by the DJP and appear instantly on your dashboard.

Faster and easier payroll tax management

Mekari Talenta helps HR calculate payroll and taxes, process payments, and issue e-Bupot directly and seamlessly from one platform.

Questions about Talenta x Klikpajak

What is the integration of Mekari Talenta with eBupot?

This integration enables companies to generate PPh 21/26 eBupot withholding slips directly from payroll data in Mekari Talenta without the need to export or manually input data into other systems. All eBupot formats comply with DJP regulations.

Mekari Talenta is directly connected to DJP Coretax through Mekari Klikpajak, an official DJP partner.

What types of eBupot can be created in Mekari Talenta?

Mekari Talenta supports the creation of various types of withholding slips, including:

- Formulir 1721-VI

- Formulir 1721-VII

- Formulir 1721-VIII

- Formulir 1721-A1

What are the main benefits of this integration for HR and Finance?

- No need to export payroll data to create withholding slips.

- Reduced risk of manual input errors.

- Withholding slips are automatically generated based on income and deduction data in Mekari Talenta.

Is payroll and tax data secure?

Yes, the platform supports open API integration, allowing direct connection with your company’s HR, payroll, or ERP systems without manual data migration.

Can this system be adapted to the needs of large companies?

Security is guaranteed. Mekari Talenta and Klikpajak are ISO 27001 certified and comply with DJP’s data security standards.

Manage payroll and PPh 21/26 in one secure and integrated system.

Leave manual process, ensure compliance, and send official eBupot directly from your payroll software.