- A payroll management system helps companies manage salaries, taxes, and payroll processes more accurately and efficiently.

- For smoother and automated payroll management, companies can use solutions like Mekari Talenta.

Managing employee payroll is one of the most critical responsibilities for any organization, regardless of its size or industry.

As companies grow, handling salaries, taxes, benefits, and compliance manually becomes increasingly complex and error-prone.

This is where understanding what is a payroll management system becomes essential for HR and business leaders.

A payroll management system helps organizations streamline payroll processes, improve accuracy, and ensure employees are paid correctly and on time.

This article will explain what a payroll management system is, how it works, its key components, and why it plays a vital role in modern business operations.

What Is a Payroll Management System?

A payroll system, also known as a payroll management system, is an employee payroll administration system used by companies to manage salary calculation and payment processes.

When people discuss what is a payroll management system, it refers to a structured system that helps organizations handle employee compensation accurately and consistently.

This process includes calculating base salary, allowances, tax deductions, and additional benefits such as bonuses or commissions.

Every company inevitably has a payroll system in place, as payroll is a fundamental operational requirement.

Typically, the Human Resources department is responsible for managing this process on a monthly basis.

By using a payroll management system, HR teams can perform payroll tasks more efficiently and accurately compared to manual payroll processing, which is highly prone to human error.

Benefits of Using a Payroll Management System for Companies

Below are some of the key benefits of implementing a payroll management system within a company.

1. Time Efficiency

By using a computerized payroll management system, companies can significantly reduce the time previously spent on manual payroll calculations.

Payroll processing can be completed faster and more accurately, allowing businesses to focus more on their core operational and strategic activities.

One of Mekari Talenta’s clients, Persada, previously needed up to one week to complete payroll processing, but after implementing a payroll management system, the process was reduced to just 1–2 days.

2. Accuracy in Employee Salary Calculation

An automated payroll management system helps minimize human errors in calculating employee salaries and benefits, ensuring that each employee receives fair and accurate compensation. This level of accuracy is essential for maintaining employee trust and payroll compliance.

At PT Amidis Tirta Mulia, payroll processing that previously involved manual calculations for over 400 employees is now completed automatically, helping the company process payroll up to 48 times faster while significantly reducing calculation errors.

3. Integrated Data Management

A payroll management system is usually part of a broader HR software platform used by employees.

Other features commonly included in HR software include attendance tracking and time management.

Employee attendance data stored in the system is automatically reflected in payroll calculations once the payroll period begins.

As a result, HR teams no longer need to manually calculate employee salaries based on attendance records.

RS Binawaluya experienced this firsthand after centralizing attendance and payroll data, enabling HR to complete attendance and payroll recaps in 1–2 days instead of the previous 5–7 days.

4. Cost Savings

A payroll management system can also help companies identify unnecessary employee-related expenses, such as excessive insurance costs or inaccurate tax deductions.

By conducting regular payroll audits, companies can reduce costs and improve overall operational efficiency.

In conclusion, implementing a payroll management system provides significant benefits for companies, including improved time efficiency and higher payroll accuracy.

Methods of Payroll Management

Companies generally manage payroll using three main methods, depending on company size, resources, and operational complexity.

Each method has its own advantages and limitations, and the right approach often evolves as a business grows.

1. Manual Payroll Management

Manual payroll management relies heavily on spreadsheets and manual calculations to process employee salaries, taxes, and deductions.

This method is commonly used by small businesses with a limited number of employees and relatively simple payroll structures.

While manual payroll may appear cost-effective at first, it is highly time-consuming and prone to human error.

As employee numbers increase, managing attendance data, overtime, and statutory deductions manually becomes increasingly difficult and risky.

Manual payroll also lacks scalability and audit readiness, making it unsuitable for growing organizations.

2. Payroll Management Using Software

Payroll management software automates key payroll processes such as salary calculation, tax deductions, attendance integration, and digital payslip distribution. This method significantly improves efficiency, accuracy, and compliance.

With centralized data and real-time updates, HR teams can focus more on strategic tasks rather than repetitive administrative work. This approach is widely adopted by mid-sized and large organizations.

3. Payroll Outsourcing

Payroll outsourcing involves transferring payroll responsibilities to an external service provider. This approach helps reduce internal workload, minimize compliance risks, and ensure payroll processes are handled accurately and on time.

Mekari Talenta also provides a payroll outsourcing service, allowing companies to delegate end-to-end payroll processing to a dedicated team supported by an integrated payroll management system.

With this service, businesses can rely on both payroll expertise and technology, while maintaining visibility into payroll data through a centralized platform.

How a Payroll Management System Works

To better understand what is a payroll management system, it is important to know how it operates.

In general, a payroll management system consists of three main stages, as outlined below.

Pre-Payroll Process

The pre-payroll stage focuses on preparing and validating employee data before payroll calculations begin.

During this stage, HR collects essential information such as base salary, allowances, benefits, attendance records, leave data, and overtime hours from the previous payroll period.

This data is then reviewed to ensure accuracy and completeness, as missing or incorrect information can directly impact salary outcomes.

In companies with complex work schedules or shift-based operations, this process can be particularly challenging.

An integrated HRIS significantly streamlines this stage by automatically consolidating attendance, leave, and overtime data into a single system, reducing manual input and the risk of errors.

Read also: HRIS vs HRMS vs HCM: What’s the Difference & What to Consider?

Payroll Processing & Calculation

Once all data has been validated, it is entered into the payroll management system for calculation.

At this stage, the system automatically applies payroll rules, including tax calculations, statutory deductions, benefits, and overtime payments.

The system then generates each employee’s net salary based on these calculations. HR teams typically review the payroll output to ensure accuracy and compliance before final approval.

After confirmation, salaries are distributed directly to employees’ bank accounts through secure payment channels.

Post-Payroll Process

The post-payroll stage involves documentation, reporting, and compliance activities. Employee tax data and statutory contributions are recorded, and payroll reports are prepared for submission to relevant tax and regulatory authorities.

HR teams also coordinate with finance teams to reconcile payroll transactions and ensure accurate financial records.

Finally, employees receive their digital payslips, which serve as official proof of salary payment and provide transparency regarding salary components.

Key Components of a Payroll Management System

Using an HRIS for employee payroll still involves the same core components found in manual payroll systems.

However, with HRIS implementation, payroll processes become digitalized and significantly easier to manage.

To fully understand what is a payroll management system, it is essential to recognize the components involved.

Below are the key payroll components that must be included in employee payroll calculations.

1. Base Salary

Base salary is the fixed amount of compensation agreed upon by the employer and the employee.

Although minimum wage regulations may exist in many countries, base salary amounts are determined by company policies and employment agreements.

Base salary is the most critical component in payroll calculations and must always be included in the payroll management system.

Understanding this component makes it easier to grasp how payroll systems work.

2. Allowances

Allowances are additional payments provided to employees for specific purposes.

Including allowances in the payroll management system ensures more accurate payroll calculations.

Not all employees receive allowances, as these payments depend on company policies and employment agreements.

3. Income Tax

Income tax refers to mandatory tax deductions applied to employee salaries based on government regulations.

These tax components must be included in payroll processing to ensure that both companies and employees meet their legal tax obligations.

4. Deductions (Social Security and Employment Contributions)

Companies are generally required to deduct social security and employment-related contributions from employee salaries.

These deductions benefit employees by providing health coverage, employment protection, and retirement benefits.

5. Incentives or Overtime Pay

Overtime compensation must be included in the payroll management system.

Incentives or overtime pay are wages earned by employees who work beyond standard working hours.

This component is essential, as overtime regulations are typically governed by labor laws.

After understanding all payroll components, you should now have a clearer understanding of what a payroll management system is.

Next, you can learn how employee salaries are calculated in detail.

Why Payroll Management System Security Is Critical?

Below are the reasons why a payroll management system must maintain a high level of security.

1. Protecting Employee Databases

Employee databases contain highly sensitive information, including banking details, personal data, education history, and family information.

Employee data protection is regulated by data privacy laws in many countries.

Companies are legally obligated to protect this information from unauthorized access, misuse, or data breaches.

If employee data is leaked, companies may face legal action and reputational damage.

Therefore, companies must carefully select reliable and secure payroll software to protect employee information.

2. Preventing Data Theft and Cyberattacks

Data theft poses serious risks, as stolen information can be misused without the owner’s consent.

A secure payroll management system protects companies from data theft and potential misuse.

Ideally, payroll software should have strong security reviews and transparent security policies.

Vendors should be able to explain how they prevent cyberattacks and safeguard employee data.

Cyberattacks may not occur daily, but when they do, companies without adequate security measures can suffer significant financial losses. Managing employee data securely is a necessity, not an option.

3. Ethical Data Management

Protecting employee privacy is a core value every company must uphold. Beyond maintaining a positive corporate image, ethical data management supports employee trust and retention.

Employees entrust companies with their personal information, and companies must honor this responsibility by ensuring strong payroll system security.

4. Transaction Security

A payroll management system enables companies to provide digital salary transfer records and electronic payslips. Digital records are easier to store and manage compared to paper-based documentation.

Payslips promote transparency by clearly outlining salary components for each pay period.

Since payroll data is highly confidential, secure delivery of payslips is essential.

Transaction security is also critical for salary payments, tax calculations, statutory contributions, and payments involving vendors or partners. Unsecured payroll systems may expose employee bank accounts to fraud or unauthorized access.

With a secure payroll management system, sensitive financial data such as bank account numbers and balances remain protected from unauthorized parties.

Tips for Managing Payroll

Managing payroll effectively is essential for ensuring employee satisfaction, regulatory compliance, and smooth business operations.

Payroll errors can lead to delayed salary payments, compliance issues, and a loss of employee trust.

As organizations grow and payroll structures become more complex, relying on ad hoc processes or manual calculations can quickly create inefficiencies.

Below are practical tips that organizations can apply to manage payroll more efficiently, regardless of company size or industry.

1. Maintain Accurate and Up-to-Date Employee Data

Accurate payroll starts with reliable employee data. Companies should regularly update employee records, including salary structures, job roles, tax status, benefits, and bank account details.

Changes such as promotions, salary adjustments, or role transfers must be reflected in the system immediately.

Inaccurate or outdated data often leads to payroll discrepancies that require time-consuming corrections and can negatively affect employee trust.

2. Establish Clear Payroll Policies and Schedules

Clear payroll policies help standardize how salaries, overtime, bonuses, and deductions are calculated.

Companies should document payroll rules and ensure they align with labor regulations and internal agreements.

In addition, setting a consistent payroll schedule allows employees to know exactly when they will be paid, which supports financial planning and reduces payroll-related inquiries to HR teams.

3. Conduct Regular Payroll Reviews and Audits

Regular payroll audits help identify inconsistencies, duplicate entries, or incorrect deductions before they become larger issues.

Reviewing payroll reports on a monthly or quarterly basis enables HR and finance teams to ensure accuracy and compliance with regulations.

Audits also help companies identify inefficiencies in payroll processes that can be improved over time.

4. Ensure Compliance with Tax and Labor Regulations

Payroll regulations and tax requirements often change and vary across regions. Companies must stay informed about applicable tax rates, statutory deductions, and labor laws to avoid penalties and legal risks.

Assigning responsibility for compliance monitoring or consulting with payroll experts can help ensure that payroll processes remain aligned with current regulations.

5. Use Payroll Software to Automate and Streamline Processes

Using payroll software is one of the most effective ways to manage payroll efficiently. Payroll management systems automate salary calculations, tax deductions, attendance integration, and payslip distribution, significantly reducing manual effort and human error.

With centralized data and real-time updates, HR teams can process payroll faster, maintain accuracy, and focus on strategic workforce initiatives rather than repetitive administrative tasks.

Read also: How to Choose the Right HRIS Vendor: A Practical HR Guide

Simplify and Streamline Payroll Management with Mekari Talenta

Managing payroll does not have to be time-consuming or complex. With Mekari Talenta, companies can simplify payroll processes while maintaining accuracy, compliance, and full control over employee compensation.

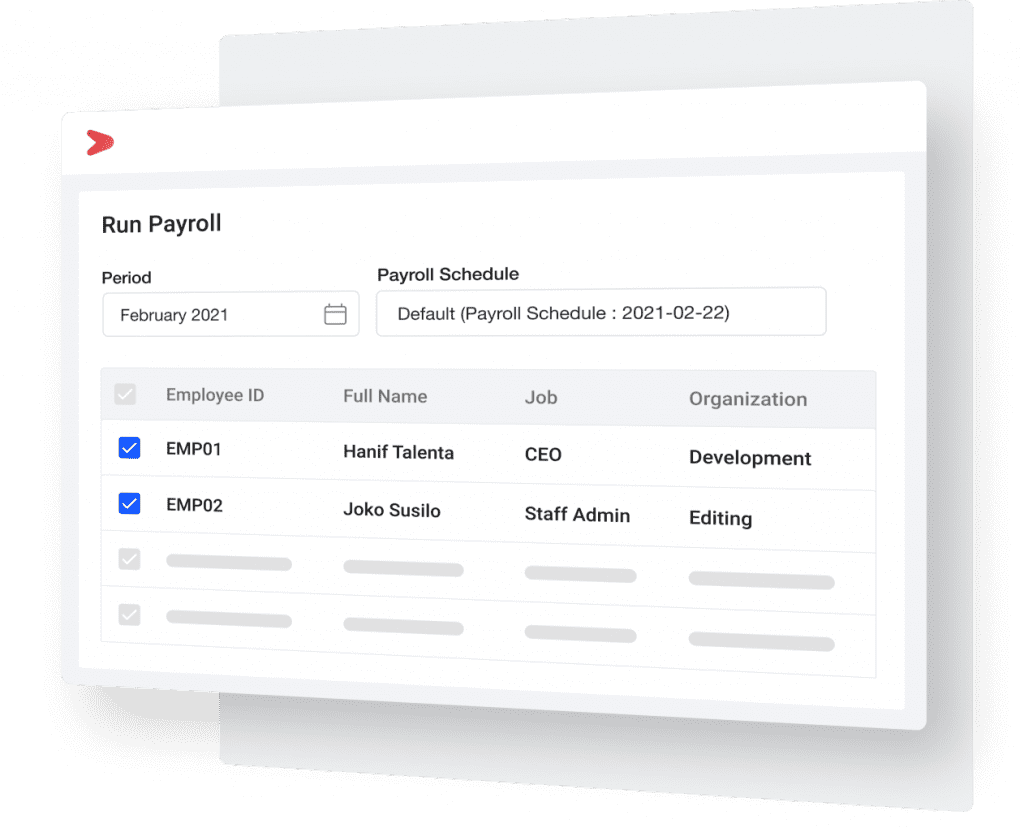

Mekari Talenta is a payroll software designed to automate end-to-end payroll management, helping HR teams eliminate manual calculations, reduce errors, and process payroll significantly faster.

With Mekari Talenta’s payroll system, companies can manage payroll more efficiently through features such as:

- Automated payroll calculation that complies with the latest tax and labor regulations

- Accurate payroll component recap without manual double data entry

- Automatic calculation of taxes, social security, benefits, and allowances

- On-time salary and payslip distribution directly from the system

- Bank integration for easier and more flexible salary transfers

- Centralized payroll dashboard for better visibility and monitoring

Beyond payroll, Mekari Talenta also offers a comprehensive HR ecosystem to support broader workforce management needs, including:

- Attendance management with real-time tracking

- Leave and overtime management

- Employee self-service (ESS) for payslips and personal data access

- HR analytics and reporting to support data-driven decisions

Mekari Talenta is suitable for businesses across various stages, from small businesses looking to move away from manual payroll, to mid-sized companies seeking better efficiency, and large enterprises with complex payroll structures and multiple branches.

If you are looking to simplify payroll processes and gain better control over payroll management, schedule a demo with Mekari Talenta and see how an integrated payroll system can support your business growth.